Mint holds firm as global uncertainty weighs on markets

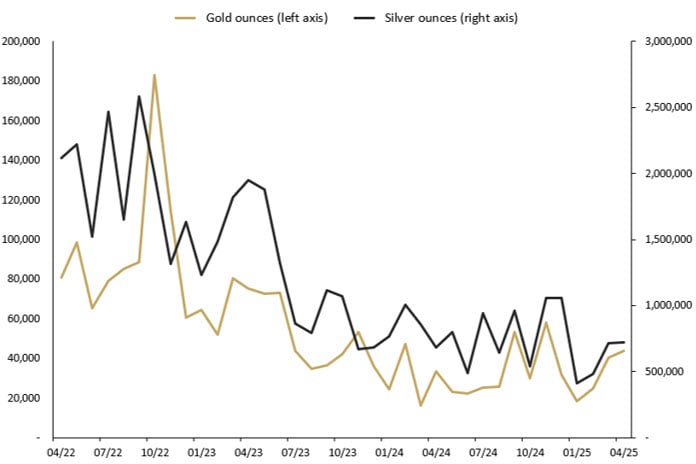

The Perth Mint sold 43,714 troy ounces (oz) of gold and 723,641 oz of silver in minted product form during April 2025.

Opening the month around USD 3,120, gold was caught up in the Trump Administration’s tariff announcements - and China’s retaliatory tariffs - that caused global stock markets to plunge and a sharp increase in volatility stoking brief fears of a global recession.

This caused gold to drop below USD 3,000 as investors liquidated assets to raise cash or meet margin calls. But from its low point on 8 April, gold rallied by more than USD 500 to trade above USD 3,500 as the market continued to digest the impact of a possible tariff war between the world’s two biggest economies.

This uncertainty saw a large flight to safety with gold the standout performer. Towards the end of the month the US softened its tariffs stance with US Treasury Secretary Scott Bessent saying there would need to be a de-escalation in trade tensions. Gold lost its appeal as a result and the price retreated to about USD 3,300 for a monthly gain of more than 5.5%.

In Australian dollar terms, the gold price dropped below AUD 5,000 based on the prevailing international news and sentiment, before rallying to trade intramonth at record highs. By the end of the month, and impacted by a stronger Australian dollar, gold was around AUD 5,125, for a monthly gain of about 3%.

In a similar vein to gold, silver was heavily liquidated as investors sold out of profitable positions to raise cash or meet margin calls. Early month volatility saw silver drop to USD 28.50 before rallying. But silver failed to receive the same level of support as gold which confirmed its reputation as the safe haven asset. At month end silver was trading around USD 32.30 to record a monthly loss of over 5%.

The silver price in Australian dollar terms was down materially for the month of April as the stronger AUD exchange rate coupled with the price drop in USD terms resulted in a monthly loss of more than 7%.

The Gold Silver Ratio was close to 100 at the end of month as gold outperformed silver to record the highest level in the past year.

Minted products

The Perth Mint sold 43,714 oz of gold and 723,641 oz of silver in minted product form during April.

The table below highlights how these numbers compare to sales seen one month, three months and one year ago.

Precious metal

Current month

1 month %

3 months %

12 months %

Gold

43,714

8%

136%

31%

Silver

723,641

1%

74%

6%

APRIL 2025 SALES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS (TROY OUNCES) AND CHANGE (%) RELATIVE TO PRIOR PERIODS.

The Perth Mint’s General Manager Minted Products, Neil Vance, noted strong sales in Europe and Australia in April.

“After a period of volatility in the precious metals market, it was pleasing to see a sustained trend towards improved results,” he said.

“Our strong April sales reflect our customers’ continued support for The Perth Mint as a reliable provider of quality bullion product as well as the broader trust in gold as a safe haven asset.”

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian kangaroo, kookaburra, koala, and lunar series. In addition, periodic releases and series offer investors a choice of alternative design themes. Learn more about The Perth Mint’s upcoming releases.

Bullion coins released in April 2025

- Australian Swan 2025 1oz Silver Bullion Coin

- Australian Swan 2025 1oz Gold Bullion Coin

Bullion coins recently ‘sold out’ at The Perth Mint

- Australian Brumby 2024 1oz Silver Bullion Coin

Please note: The figures stated in this article are for total monthly ounces of gold and silver shipped as minted products by The Perth Mint to wholesale and retail customers worldwide during April 2025. They exclude sales of cast bars and other activities including sales of allocated/unallocated precious metals for storage by The Perth Mint Depository.

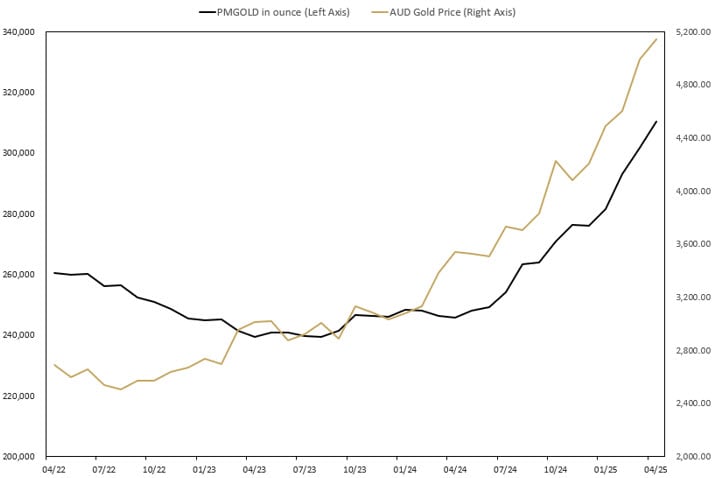

Perth Mint Gold Structured Product (ASX:PMGOLD)

Perth Mint Gold Structured Product is a low cost exchange traded product (ETP) that allows investors to trade in gold via a stock broking account as they would shares on the ASX. To learn more, visit the PMGOLD web page.

Total holdings in Perth Mint Gold Structured Product (ASX:PMGOLD) increased during April with holdings up by 8,731 oz (2.89%). This brings total holdings in PMGOLD to 310,320 ounces (9.65 tonnes).

MONTHLY CHANGE IN TROY OUNCES HELD BY CLIENTS IN PERTH MINT GOLD STRUCTURED PRODUCT (ASX:PMGOLD) APRIL 2022 TO APRIL 2025