Gold and silver prices push higher in August

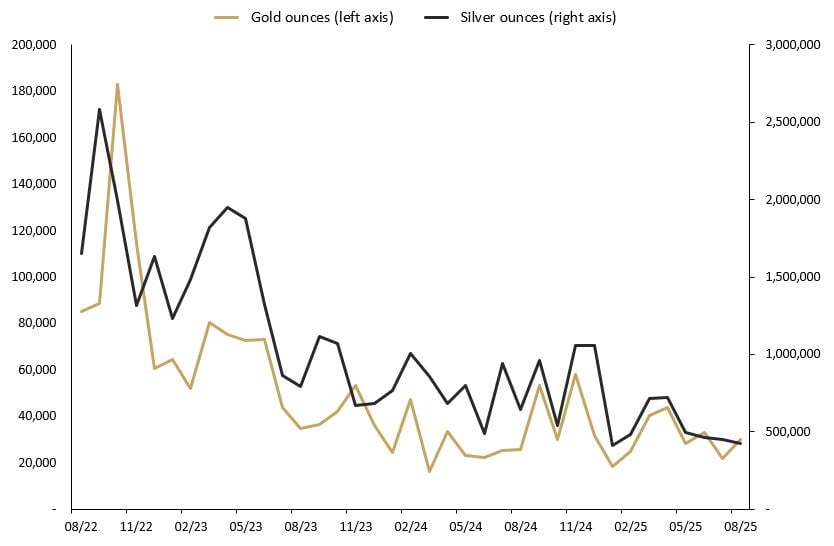

The Perth Mint sold 30,125 troy ounces (oz) of gold and 424,949 oz of silver in minted product form during August 2025.

Opening the month just under USD 3,300, gold was supported in early August by a softer-than-expected July non-farm payrolls report, which raised concerns about the strength of the US economy and increased expectations of Federal Reserve rate cuts as early as September. Following this early lift, gold traded in a narrow range for most of the month with resistance levels proving difficult to break. Trade policy developments, particularly tariff announcements, were a key influence on the gold price. In the final week of August, gold rallied above USD 3,400 following the release of US inflation data which further reinforced expectations of a September rate cut. By month end, gold was trading close to USD 3,450 representing a gain of 4%.

In Australian dollar terms, gold climbed more than AUD 150 from its opening lows to almost AUD 5,250 before retreating - and then rallying again - to finish the month above AUD 5,300, edging towards all-time highs. The strengthening Australian dollar weighed on performance however, with AUD-priced gold underperforming against USD-priced gold. Overall, gold recorded a gain of just over 2% in AUD terms.

Silver also enjoyed another strong month surging to its highest level since 2011. Its rally was supported by attractive relative value to gold, key technical breakouts, and ongoing supply deficits. By the end of the month, silver was trading near USD 39 for a 7% gain.

In Australian dollar terms silver ended the month more than 5.5% higher, at around AUD 59.50. Gains were partially tempered by the stronger local currency.

The Gold Silver Ratio was near 87 at the end of month.

Minted products

The Perth Mint sold 30,125 oz of gold and 424,949 oz of silver in minted product form during August.

The table below highlights how these numbers compare to sales seen one month, three months and one year ago.

Precious metal

Current month

1 month %

3 months %

12 months %

Gold

30,125

38%

7%

16%

Silver

424,949

- 6%

- 14%

- 34%

AUGUST 2025 SALES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS (TROY OUNCES) AND CHANGE (%) RELATIVE TO PRIOR PERIODS.

The Perth Mint’s General Manager Minted Products, Neil Vance, noted a pleasing uptick in gold sales for August.

“We saw strong pre-order momentum from our wholesale partners ahead of our latest Lunar program release for the Year of the Horse,” he said.

“This strong, early demand demonstrates both the continued appeal of our Australian Lunar series and the market's confidence in precious metals as we approached the highly anticipated launch."

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian kangaroo, kookaburra, koala, and lunar series. In addition, periodic releases and series offer investors a choice of alternative design themes.

Bullion coins released in August 2025

- Australian Brumby 2025 1oz Silver Bullion Coin

Please note: The figures stated in this article are for total monthly ounces of gold and silver shipped as minted products by The Perth Mint to wholesale and retail customers worldwide during August 2025. They exclude sales of cast bars and other activities including sales of allocated/unallocated precious metals for storage by The Perth Mint Depository.

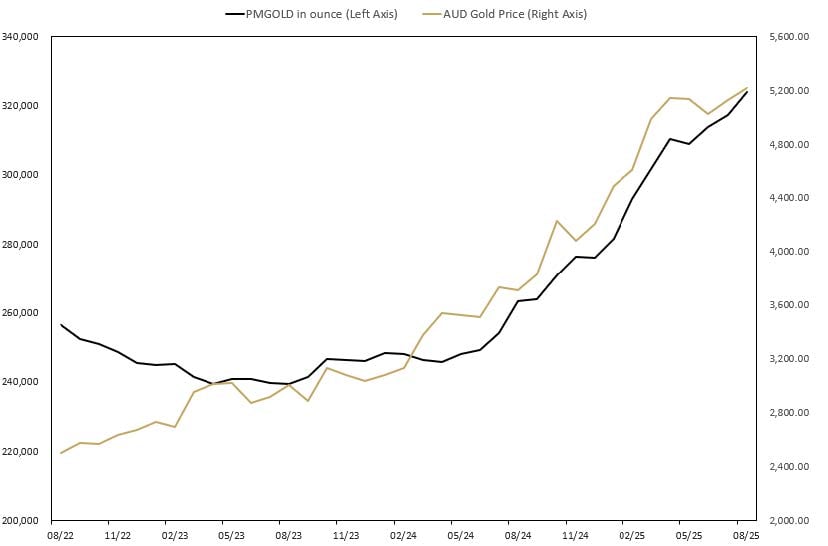

Perth Mint Gold Structured Product (ASX:PMGOLD)

Perth Mint Gold Structured Product is one of the lowest cost gold exchange traded products (ETP) that allows investors to trade in gold via a stockbroking account as they would shares on the ASX. To learn more, visit the PMGOLD web page.

Total holdings in Perth Mint Gold Structured Product (ASX:PMGOLD) increased during August with holdings up by 6,842 oz (2.16%). This brings total holdings in PMGOLD to 323,976 ounces (10.08 tonnes).

MONTHLY CHANGE IN TROY OUNCES HELD BY CLIENTS IN PERTH MINT GOLD STRUCTURED PRODUCT (ASX:PMGOLD) AUGUST 2022 TO AUGUST 2025