Record year for gold and silver

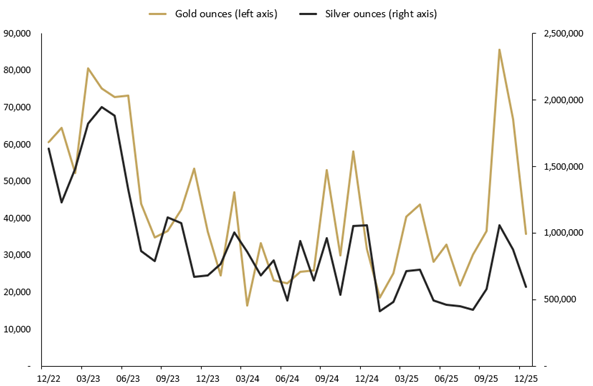

The Perth Mint sold 35,885 troy ounces (oz) of gold and 597,873 oz of silver in minted product form during December 2025.

Opening the month around USD 4,200 gold moved higher to hit a new record of approximately USD 4,549 during trading on 26 December. The strong price throughout the month was supported by same factors that have been keeping it uplifted in the prior months, namely, expectations of interest rate cuts in early 2026, uncertainty in the US economy and ongoing global instability.

Late in the month, gold and other precious metals experienced a sell-off with the price easing materially. This was widely viewed as profit-taking ahead of year end rather than a change in underlying market sentiment.

Gold finished the month trading near USD 4,310, up 3.50% for the month. For the calendar year, gold rose by approximately 65% in US dollar terms.

In Australian dollar terms, gold ended December trading around AUD 6,460 after reaching higher levels earlier in the month.

The Australian dollar strengthened approximately 2.5% during December driven by expectations of a US interest rate cut in early January 2026.

Despite some volatility, gold eked out a modest gain of 1.4% for the month while for the full calendar year gold prices increased by more than 50%.

Silver delivered a particularly strong performance in December, rising sharply and reaching multiple record highs throughout the period.

Prices briefly climbed above USD 80 an ounce, marking a new all-time high. The rally was supported by sustained global investment demand at both institutional and retail levels as well as strong industrial demand.

Towards the end of the month, silver underwent a sharp correction closing December at around USD 72. Despite this pullback, silver gained more than 33% for the month and finished 2025 up approximately 148% in US dollar terms.

In Australian dollar terms, silver traded above AUD 100 an ounce for the first time during December. Even after the late-month correction it finished the month up around 30% and was more than 130% higher for the calendar year.

The Gold Silver Ratio closed the month near 60.5 reflecting silver’s material outperformance relative to gold during the period. This represents the lowest level for the ratio since July 2021.

Minted products

The Perth Mint sold 35,885 oz of gold and 597,873 oz of silver in minted product form during December.

The table below highlights how these numbers compare to sales seen one month, three months and one year ago.

Precious metal

Current month

1 month %

3 months %

12 months %

Gold

35,885

-46%

-2%

13%

Silver

597,873

-32%

3%

-43%

DECEMBER 2025 SALES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS (TROY OUNCES) AND CHANGE (%) RELATIVE TO PRIOR PERIODS.

The Perth Mint’s General Manager Minted Products, Neil Vance, noted the softer sales typically associated with the holiday period.

“December is traditionally a quieter period for precious metals as customers turn their attention to the holiday and festive season,” Mr Vance said.

“We saw particularly strong demand for our silver 1oz kangaroo coins and our 1oz silver minted bars, including both kangaroo and lunar designs, reflecting continued investor appetite for trusted, quality products.

“In gold, minted bars performed strongly, reinforcing their ongoing appeal as a core investment choice during periods of market volatility.”

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program.

Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian kangaroo, kookaburra, koala, and lunar series. In addition, periodic releases and series offer investors a choice of alternative design themes.

Bullion coins released in December 2025

- Australian Lunar Series III 2026 Year of the Horse 1oz Silver Bullion Coin with Dragon Privy

- Australian Lunar Series III 2026 Year of the Horse 1oz Gold Bullion Coin with Dragon Privy

- Lunar Horse 2026 1oz Silver Rectangular Individual Bullion Coin

- Lunar Horse 2026 1oz Silver Rectangular Bullion Coin in Tube

- Lunar Horse 1oz Gold Minted Bar

Please note: The figures stated in this article are for total monthly ounces of gold and silver shipped as minted products by The Perth Mint to wholesale and retail customers worldwide during December 2025. They exclude sales of cast bars and other activities including sales of allocated/unallocated precious metals for storage by The Perth Mint Depository.

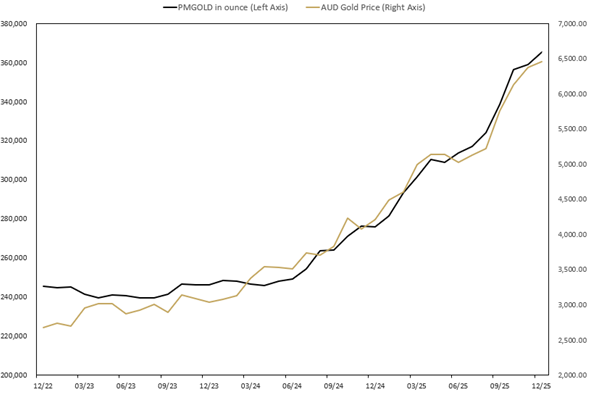

Perth Mint Gold Structured Product (ASX:PMGOLD)

Perth Mint Gold Structured Product is a low cost exchange traded product (ETP) that allows investors to trade in gold via a stockbroking account as they would shares on the ASX. To learn more, visit the PMGOLD web page.

Total holdings in Perth Mint Gold Structured Product (ASX:PMGOLD) increased during December with holdings up by 6,402 oz (1.78%). This brings total holdings in PMGOLD to 365,338 ounces (11.36 tonnes).

MONTHLY CHANGE IN TROY OUNCES HELD BY CLIENTS IN PERTH MINT GOLD STRUCTURED PRODUCT (ASX:PMGOLD) DECEMBER 2022 TO DECEMBER 2025.