Silver demand soars amid price volatility

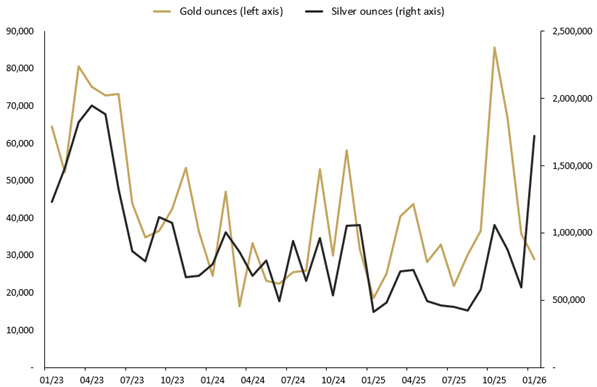

The Perth Mint sold 29,103 troy ounces (oz) of gold and 1,722,639 oz of silver in minted product form during January 2026.

Silver sales were up 188% on the previous month, while gold sales were softer, down 19% as metal prices hit new records during a volatile month.

Opening the month around USD 4,350, gold breached USD 5,000 very quickly and rallied as high as USD 5,500. At this stage the gold price was up near 30% for the month of January alone, supported by numerous factors including ongoing global instability, uncertainty in the US economy and speculation that the expected US Fed chair nominee would support lowering increase rates.

However, right at month end, gold experienced a material sell-off with prices falling more than 10% in the biggest one-day sell-off on record just two days after the biggest one-day gain. This was a result of a combination of factors, including the announcement of incoming Fed Chair Kevin Warsh resulting in technical selling combined with profit taking at month end. Gold was up approximately 15% USD for the month.

In Australian dollar terms, gold experienced the same run up and at one stage was trading close to AUD 8,000 before correcting sharply at month end. A materially stronger AUD-US exchange rate contributed to under performance in AUD gold. Gold was up 13% for the month.

Silver again delivered an impressive performance, rising to new records on a near daily basis for much of January before correcting sharply. Silver rallied from USD 75 to near USD 120, up 60% at one stage, supported by sustained global investment demand at both institutional and retail levels as well as strong industrial demand. Even after the sharp correction silver was trading above USD 100 at month end for a gain of more than 40%.

The silver price traded close to AUD 170 at its highest point and at month end was trading near AUD 150, recording a monthly gain of more than 35%.

The Gold Silver Ratio was near 59 at the end of month having dipped as low as 43.50 mid-month.

Minted products

The Perth Mint sold 29,103 oz of gold and 1,722,639 oz of silver in minted product form during January.

The table below highlights how these numbers compare to sales one month, three months and one year ago

Precious metal

Current month

1 month %

3 months %

12 months %

Gold

29,103

- 19%

- 66%

57 %

Silver

1,722,639

188%

62%

315%

JANUARY 2026 SALES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS (TROY OUNCES) AND CHANGE (%) RELATIVE TO PRIOR PERIODS.

The Perth Mint’s General Manager Minted Products, Neil Vance, said the demand for silver products was extraordinary, with strong interest globally from the US, Europe and Asian markets as well as Australia.

“With the sustained interest in silver bullion, we have focused our production efforts on our core products to ensure we meet our customers’ expectations. The focus of demand has been on silver kangaroo coins and silver kilobars, while the silver kookaburra coin was launched in January to strong sales.” Mr Vance said.

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian kangaroo, kookaburra, koala, and lunar series. In addition, periodic releases and series offer investors a choice of alternative design themes.

Please note: The figures stated in this article are for total monthly ounces of gold and silver shipped as minted products by The Perth Mint to wholesale and retail customers worldwide during January 2026. They exclude sales of cast bars and other activities including sales of allocated/unallocated precious metals for storage by The Perth Mint Depository.

New bullion releases in January 2026

- Australian Kookaburra 2026 1 Kilo Silver Bullion Coin

- Australian Kookaburra 2026 10oz Silver Bullion Coin

- Australian Kookaburra 2026 1oz Silver Bullion Coin

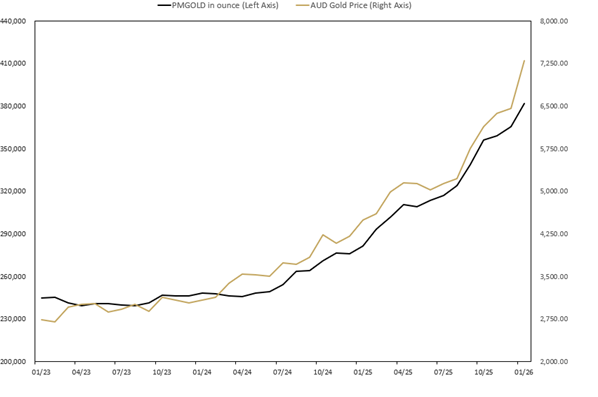

Perth Mint Gold Structured Product (ASX:PMGOLD)

Perth Mint Gold Structured Product continued to reach all-time highs in January. Total holdings increased during the month by 16,330 oz (4.47%) to 381,668 ounces (11.87 tonnes).

PMGOLD is a low-cost exchange traded product (ETP) that allows investors to trade in gold via a stockbroking account as they would shares on the ASX. To learn more, visit the PMGOLD webpage.

MONTHLY CHANGE IN TROY OUNCES HELD BY CLIENTS IN PERTH MINT GOLD STRUCTURED PRODUCT (ASX:PMGOLD) January 2023 TO January 2026