July sales softer as seasonal pattern tempers market activity

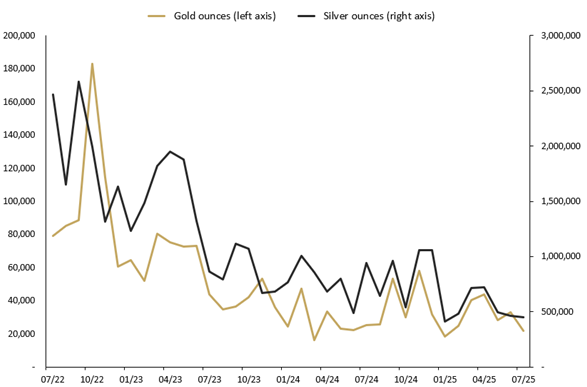

The Perth Mint sold 21,891 troy ounces (oz) of gold and 452,132 oz of silver in minted product form during July 2025.

Opening the month around USD 3,300, gold traded within a relatively narrow range for the majority of July. As in previous months, trade policies – particularly tariff announcements – were the major contributing factor to the gold price. Midway through the month gold briefly climbed above USD 3,400 following a decline in the US dollar and renewed investor interest in safe-haven assets. This was triggered in part by President Donald Trump’s renewed criticism of Jerome Powell and the independence of the Federal Reserve, alongside broader calls from within the administration for scrutiny of the institution. Late in the month, gold retreated after a US-EU trade deal introduced a 15% tariff rate on American imports, potentially dampening demand. Gold ended the month near where it began – around USD 3,300 for a flat return in July.

In Australian dollar terms, gold followed international trends trading both above and below AUD 5,100. It peaked near AUD 5,235 then fell following the US-EU trade agreement. A softer-than-expected Q2 CPI result increased expectations of an interest rate cut in August, contributing to a weaker Australian dollar. Gold finished the month at AUD 5,118 with a gain of more than 2% in AUD terms.

Silver had a significant rally in July surging to its highest price since 2011, briefly trading above USD 39. The rally was supported by strong industrial demand and ongoing supply deficits as well as its outperformance relative to gold. The price pulled back sharply toward month-end however, closing around USD 36.75 for a monthly gain of 1.85%.

The silver price in Australian dollar terms was higher in the month, with the weaker local currency supporting its value. Silver gained 4% in AUD terms ending the month trading at AUD 57.

The Gold Silver Ratio ended the month near 89.50 having dropped to 86 before rising again late in the month as the silver price dropped.

Minted products

The Perth Mint sold 21,891 oz of gold and 452,132 oz of silver in minted product form during July.

The table below highlights how these numbers compare to sales seen one month, three months and one year ago.

Precious metal

Current month

1 month %

3 months %

12 months %

Gold

21,891

-33%

-50%

-14%

Silver

452,132

-3%

-38%

-52%

JULY 2025 SALES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS (TROY OUNCES) AND CHANGE (%) RELATIVE TO PRIOR PERIODS.

The Perth Mint’s General Manager Minted Products, Neil Vance, said the easing in demand was expected.

“While July’s gold sales were softer compared to previous months, this is in line with typical seasonal patterns, particularly as trading activity slows across the northern hemisphere during summer,” Neil said.

“Silver demand remained relatively resilient and this reinforces ongoing confidence in The Perth Mint’s trusted, high-quality offerings.”

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian Kangaroo, Kookaburra, Koala, and Lunar series. In addition, periodic releases and series offer investors a choice of alternative design themes.

Bullion coins released in July 2025

- Australian Lunar Series III 2025 Year of the Snake 10 kilo Silver Bullion Coin

Bullion coins recently ‘sold out’ at The Perth Mint

- 2023 Casino Royale Poker Chip 1oz Silver Bullion Coin

- 2024 Year of the Dragon 10 Kilo Silver Bullion Coin

- 2024 Emu 1oz Silver Bullion Coin

- 2025 Wedge-tailed Eagle 1oz Silver Bullion Coin

Please note: The figures stated in this article are for total monthly ounces of gold and silver shipped as minted products by The Perth Mint to wholesale and retail customers worldwide during July 2025. They exclude sales of cast bars and other activities including sales of allocated/unallocated precious metals for storage by The Perth Mint Depository.

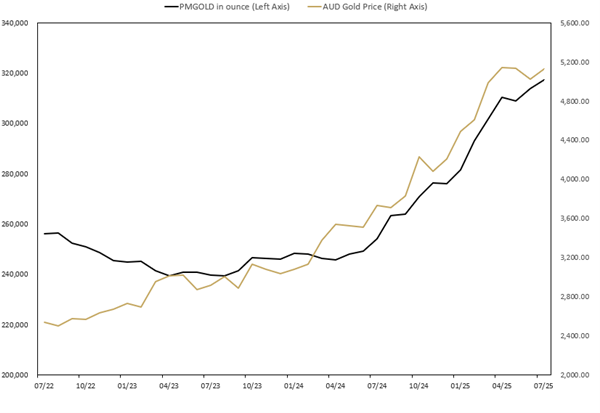

Perth Mint Gold Structured Product (ASX:PMGOLD)

Perth Mint Gold Structured Product is one of the lowest cost exchange traded products (ETP) that allows investors to trade in gold via a stockbroking account as they would shares on the ASX. To learn more, visit the PMGOLD webpage.

Total holdings in Perth Mint Gold Structured Product (ASX:PMGOLD) increased during July with holdings up by 3,439 oz (1.10%). This brings total holdings in PMGOLD to 317,134 ounces (9.86 tonnes).

MONTHLY CHANGE IN TROY OUNCES HELD BY CLIENTS IN PERTH MINT GOLD STRUCTURED PRODUCT (ASX:PMGOLD) JULY 2022 TO JULY 2025