Gold and silver sales stable as financial year wraps with strong gains

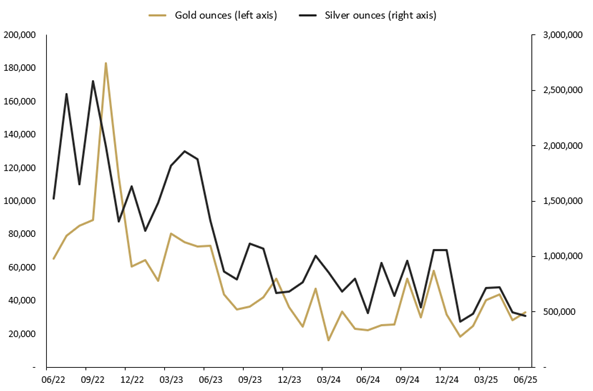

The Perth Mint sold 32,901 troy ounces (oz) of gold and 464,197 oz of silver in minted product form during June 2025.

Opening the month around USD 3,300, gold rose to a mid-month high of just under USD 3,450, supported by ongoing uncertainty surrounding US-China trade negotiations and its impact on the health of the global economy. Geopolitical tensions in the Middle East further buoyed the price as investors flocked to safe haven assets. Gold remained at elevated levels while those geopolitical issues persisted, but as stability returned the price retreated to just under USD 3,300 to record a modest loss for the month. For the financial year 2024/2025 gold returned a gain of 41% in USD terms.

In Australian dollar terms, the gold price tracked international sentiment but faced headwinds from the US dollar weakening against most currencies. The price dropped by more than 2% in June to end the month trading around AUD 5,020. However, the full financial year performance was robust with gold returning a gain of 43%.

Silver experienced a significant rally in June, surging to a 13-year high of more than USD 37. This was supported by perceived value buying as well as strong industrial demand and ongoing supply constraints. Silver ended the month around USD 36 for a near 9% gain the month. For the financial year silver returned around 23%.

In Australian dollar terms the silver price was higher in June, however the stronger AUD exchange rate tempered some of the gains. For the full financial year silver returned around 25%.

The Gold Silver Ratio was near 91.50 at the end of month with silver’s outperformance in June helping to reduce the ratio from the recent high in April.

Minted products

The Perth Mint sold 32,901 oz of gold and 464,197 oz of silver in minted product form during June.

The table below highlights how these numbers compare to sales seen one month, three months and one year ago.

Precious metal

Current month

1 month %

3 months %

12 months %

Gold

32,901

16%

-19%

46%

Silver

464,197

-7%

-35%

-6%

JUNE 2025 SALES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS (TROY OUNCES) AND CHANGE (%) RELATIVE TO PRIOR PERIODS.

The Perth Mint’s General Manager Minted Products, Neil Vance, said investor appetite for the Mint’s striking designs remained evident.

“Sales of our newly released gold and silver dragon rectangular bullion coins have been very pleasing as have our silver kangaroos which remain very popular with the German market,” he said.

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian kangaroo, kookaburra, koala, and lunar series. In addition, periodic releases and series offer investors a choice of alternative design themes. Learn more about The Perth Mint’s upcoming releases.

Bullion coins released in June 2025

- 2025 Dragon 1oz Gold Bullion Rectangular Coin

- 2025 Dragon 1oz Silver Bullion Rectangular Coin

Please note: The figures stated in this article are for total monthly ounces of gold and silver shipped as minted products by The Perth Mint to wholesale and retail customers worldwide during June 2025. They exclude sales of cast bars and other activities including sales of allocated/unallocated precious metals for storage by The Perth Mint Depository.

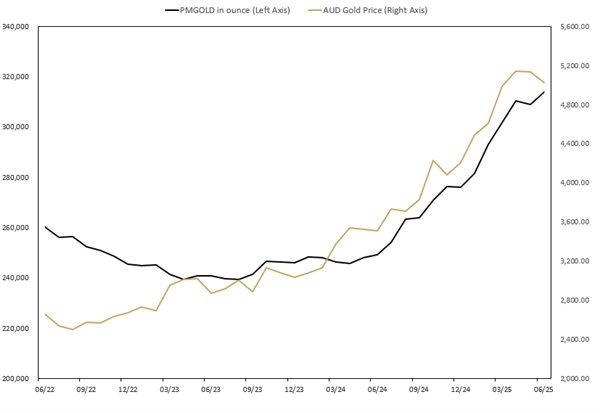

Perth Mint Gold Structured Product (ASX:PMGOLD)

Perth Mint Gold Structured Product is a low-cost exchange traded product (ETP) that allows investors to trade in gold via a stock broking account as they would shares on the ASX. To learn more, visit the PMGOLD webpage.

Total holdings in Perth Mint Gold Structured Product (ASX:PMGOLD) increased during June with holdings up by 4,796 oz (1.55%). This brings total holdings in PMGOLD to 313,695 ounces (9.76 tonnes).

MONTHLY CHANGE IN TROY OUNCES HELD BY CLIENTS IN PERTH MINT GOLD STRUCTURED PRODUCT (ASX:PMGOLD) JUNE 2022 TO JUNE 2025