Strong sales and price swings define October for precious metals

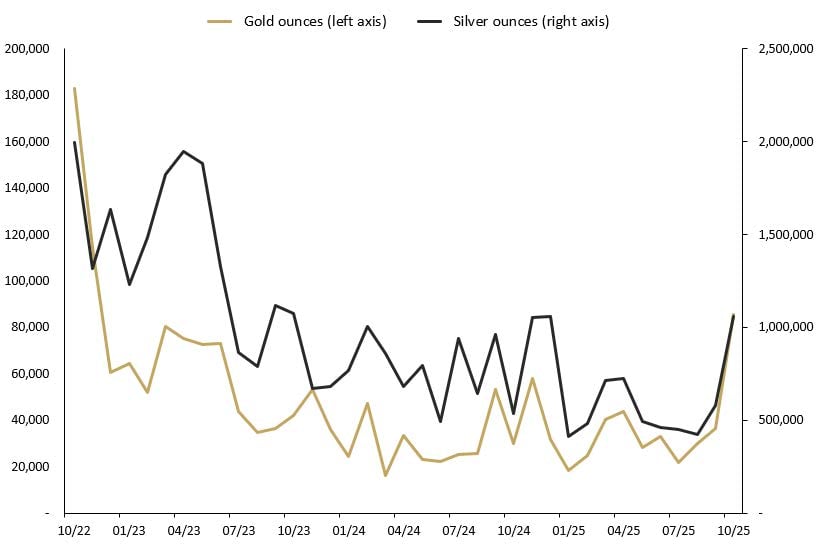

The Perth Mint sold 85,603 troy ounces (oz) of gold and 1,061,231 oz of silver in minted product form during October 2025.

Opening the month around USD 3,850, gold rallied sharply in early October, breaking through the key USD 4,000 barrier to hit an all-time high of around USD 4,380 on 17 October. The rally was driven by renewed US-China trade tensions, the debasement trade effect, and expectations of upcoming US interest rate cuts – all of which fuelled unprecedented investment demand. Late in the month, however, gold experienced its sharpest sell-off since 2020, falling more than 5% as tensions eased and profit-taking intensified. By month’s end, gold was consolidating just below USD 4,000 – still up more than 5% despite the huge volatility.

In Australian dollar terms, gold surged past AUD 6,000 early in the month setting multiple record highs before retreating in the final week. Gold ended October trading around AUD 6,130, a gain of 6.50%.

Silver followed a similar path to gold, soaring to an all-time high above USD 54 in early October, surpassing its previous 1980 peak. The rally was supported by strong investor interest in safe-haven assets and robust industrial demand. As with gold, market sentiment shifted later in the month resulting in silver prices correcting sharply, closing just below USD 49 for a monthly gain of near 6%.

In Australian dollar terms, silver traded near AUD 74.50 at month’s end, up almost 7% amid what proved to be an exceptionally volatile trading period for investors.

The Gold Silver Ratio ended October near 82.50 reflecting the significant but uneven gains and corrections across both metals during the month.

Minted products

The Perth Mint sold 85,603 oz of gold and 1,061,231 oz of silver in minted product form during October.

The table below highlights how these numbers compare to sales seen one month, three months and one year ago.

Precious Metal

Current Month

1 month %

3 months %

12 months %

Gold

85,603

134%

291%

186%

Silver

1,061,231

83%

135%

97%

October 2025 SALES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS (TROY OUNCES) AND CHANGE (%) RELATIVE TO PRIOR PERIODS.

The Perth Mint’s General Manager Minted Products, Neil Vance, said October was a strong month across all markets.

“Retail demand remained robust globally, with the United States showing particular strength in gold minted bars and Europe recording solid sales in gold coins,” Mr Vance said.

“The rising gold price drove strong interest across the board, while silver demand surged following the launch of our 2026 Silver Kangaroo coin.”

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian kangaroo, kookaburra, koala, and lunar series. In addition, periodic releases and series offer investors a choice of alternative design themes. Learn more about The Perth Mint’s upcoming releases.

Please note: The figures stated in this article are for total monthly ounces of gold and silver shipped as minted products by The Perth Mint to wholesale and retail customers worldwide during October 2025. They exclude sales of cast bars and other activities including sales of allocated/unallocated precious metals for storage by The Perth Mint Depository.

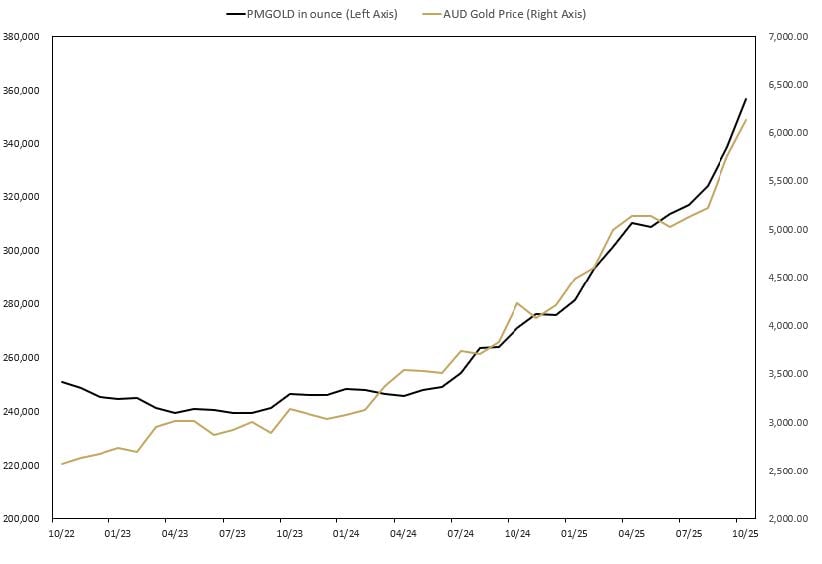

Perth Mint Gold Structured Product (ASX:PMGOLD)

Perth Mint Gold Structured Product is a low cost exchange traded product (ETP) that allows investors to trade in gold via a stockbroking account as they would shares on the ASX. To learn more, visit the PMGOLD webpage.

Total holdings in Perth Mint Gold Structured Product (ASX:PMGOLD) increased during October with holdings up by 17,614 oz (5.20%). This brings total holdings in PMGOLD to 356,186 ounces (11.08 tonnes).

MONTHLY CHANGE IN TROY OUNCES HELD BY CLIENTS IN PERTH MINT GOLD STRUCTURED PRODUCT (ASX:PMGOLD) OCTOBER 2022 TO OCTOBER 2025