Precious metal sales up as gold and silver shine

The Perth Mint sold 36,595 troy ounces (oz) of gold and 578,588 oz of silver in minted product form during September 2025.

Opening the month near USD 3,450, gold returned double digit percentage growth in September, hitting numerous records during this run. Numerous factors such as the ongoing geopolitical and economic uncertainty fuelled demand as safe haven assets came to the fore.

Mid-month, the US Federal Reserve cut interest rates by 25bps after holding rates steady for five straight meetings this year and flagged further rate cuts. This expectation helped propel the price of gold higher. At end of the month gold was trading above USD 3,800. Gold returned around 11.5% which was the biggest monthly percentage gain in over five years.

In Australian dollar terms, gold marched higher in September and hit several record highs. The slightly stronger AUD exchange rate tempered some of the gains, but gold was up more than 10% or AUD 500 for September and was trading around AUD 5,750 at the end of the month.

Silver recorded huge gains in September with the price surging to the highest levels since 2011. Its relative value to gold, technical breakouts and ongoing supply deficits continue to support silver. Unprecedented investment demand in certain markets have supported and help maintain the high price. At month end silver was trading near USD 46 for a monthly gain of over 18%.

The silver price in Australian dollar terms was also markedly higher, however the stronger AUD exchange tempered gains. For the month silver gained around 16.5%, or AUD 10, to be trading near record highs above AUD 69.

The Gold Silver Ratio was near 82 at the end of month as the outperformance of silver in September reduced the ratio.

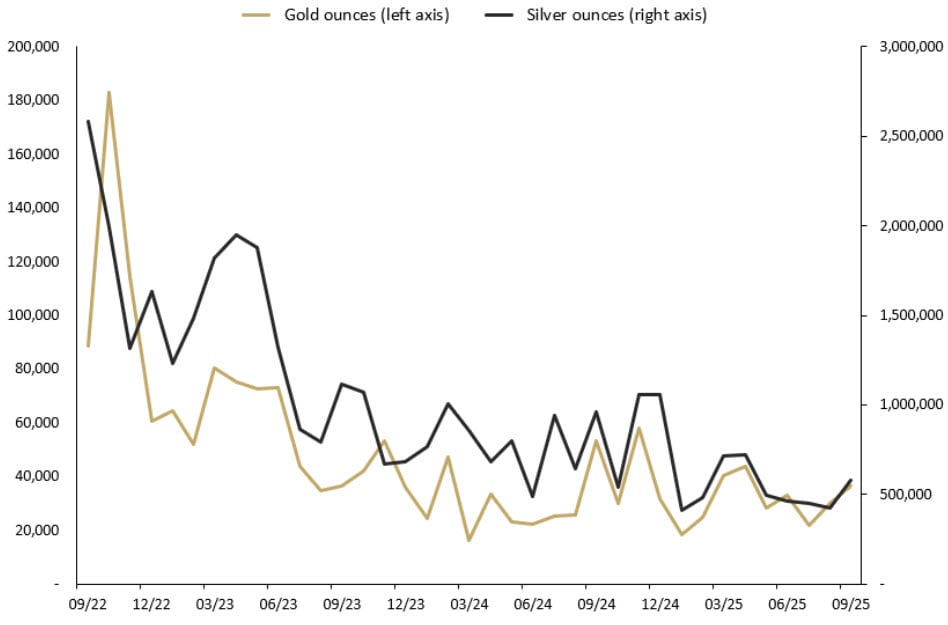

Minted products

The Perth Mint sold 36,595 oz of gold and 578,588 oz of silver in minted product form during September.

The table below highlights how these numbers compare to sales seen one month, three months and one year ago.

Precious metal

Current month

1 month %

3 months %

12 months %

Gold

36,595

21%

11%

-31%

Silver

578,588

36%

25%

-40%

September 2025 SALES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS (TROY OUNCES) AND CHANGE (%) RELATIVE TO PRIOR PERIODS.

The Perth Mint’s General Manager Minted Products, Neil Vance, said strong demand for the new Australian Lunar Series Year of the Horse coins helped drive the result.

“Our designer Ing Ing Jong’s majestic horse designs have proved hugely popular with our collectors who always love her work,” Neil said.

“So I’m not surprised we’re seeing those coins sell so well.

“And we’re also seeing very strong demand out of the US for our minted bars which has further boosted this result.”

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian kangaroo, kookaburra, koala, and lunar series. In addition, periodic releases and series offer investors a choice of alternative design themes.

Bullion coins released in September 2025

- Australian Lunar Series III 2025 Year of the Snake 2oz Gold Bullion Coin

- Australian Lunar Series III 2025 Year of the Snake 1oz Gold Bullion Coin

- Australian Lunar Series III 2025 Year of the Snake 1/2oz Gold Bullion Coin

- Australian Lunar Series III 2025 Year of the Snake 1/4oz Gold Bullion Coin

- Australian Lunar Series III 2025 Year of the Snake 1/10oz Gold Bullion Coin

- Australian Lunar Series III 2025 Year of the Snake 2oz Silver Bullion Coin

- Australian Lunar Series III 2025 Year of the Snake 1oz Silver Bullion Coin

- Australian Lunar Series III 2025 Year of the Snake 1/2oz Silver Bullion Coin

- Australian Lunar Series III 2025 Year of the Snake 1oz Platinum Bullion Coin

- Australian Emu 2024 1oz Silver Bullion Coin

- Australian Emu 2024 1oz Gold Bullion Coin

Please note: The figures stated in this article are for total monthly ounces of gold and silver shipped as minted products by The Perth Mint to wholesale and retail customers worldwide during September 2025. They exclude sales of cast bars and other activities including sales of allocated/unallocated precious metals for storage by The Perth Mint Depository.

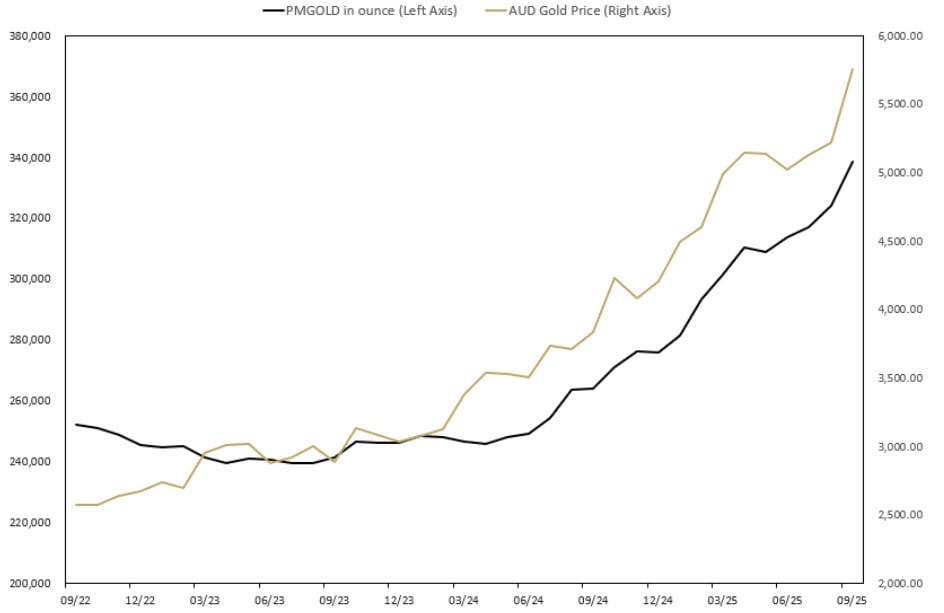

Perth Mint Gold Structured Product (ASX:PMGOLD)

Perth Mint Gold Structured Product is one of the lowest cost exchange traded products (ETP) that allows investors to trade in gold via a stockbroking account as they would shares on the ASX. To learn more, visit the PMGOLD webpage.

Total holdings in Perth Mint Gold Structured Product (ASX:PMGOLD) increased during September with holdings up by 14,596 oz (4.51%). This brings total holdings in PMGOLD to 338,572 ounces (10.53 tonnes).

MONTHLY CHANGE IN TROY OUNCES HELD BY CLIENTS IN PERTH MINT GOLD STRUCTURED PRODUCT (ASX:PMGOLD) SEPTEMBER 2022 TO SEPTEMBER 2025