Bullion demand takes a break as gold and silver price rally in July

- The Perth Mint sold 44,009 troy ounces (oz) of gold and 863,485 oz of silver in minted product form during July 2023.

- The Perth Mint Depository saw total gold holdings decrease by 0.95%, while silver holdings dropped by 0.23% during the month.

- Holdings in The Perth Mint listed ETP, ASX:PMGOLD, decreased for the month, down by 0.48%.

Early July gold traded in a narrow range until the release of June US CPI data which registered its smallest rise in two years. Changing the mood and tempo of gold trading, the announcement triggered a sharp and sustained rally. Gold finished above USD 1,950 on 12 July, maintaining this level for the rest of the month. Meanwhile, the FOMC’s decision to raise rates by 25bps to a 22-year high was broadly expected, having little impact on the gold price. By the end of July gold had gained about 2.6%, recovering its losses from June.

The gold price in Australian dollars recovered in July to end the month above AUD 2,900, gaining a little over 1.5% over the month with a strengthening United States dollar gold price offset by a stronger Australian dollar. During the month, the RBA put interest rates on hold for a second consecutive month.

Silver experienced one of its best monthly gains in 2023, up a little over 8% in US dollar terms and ending the month above USD 24. Shifting U.S. monetary policy, robust economic activity, and industrial demand driven by the global green energy transition also supported silver prices.

The silver price in Australian dollars was materially higher in July up near 7% for the month.

With a big rally in silver during July, the Gold Silver Ratio ended the month on 80.44, reversing its recent trend.

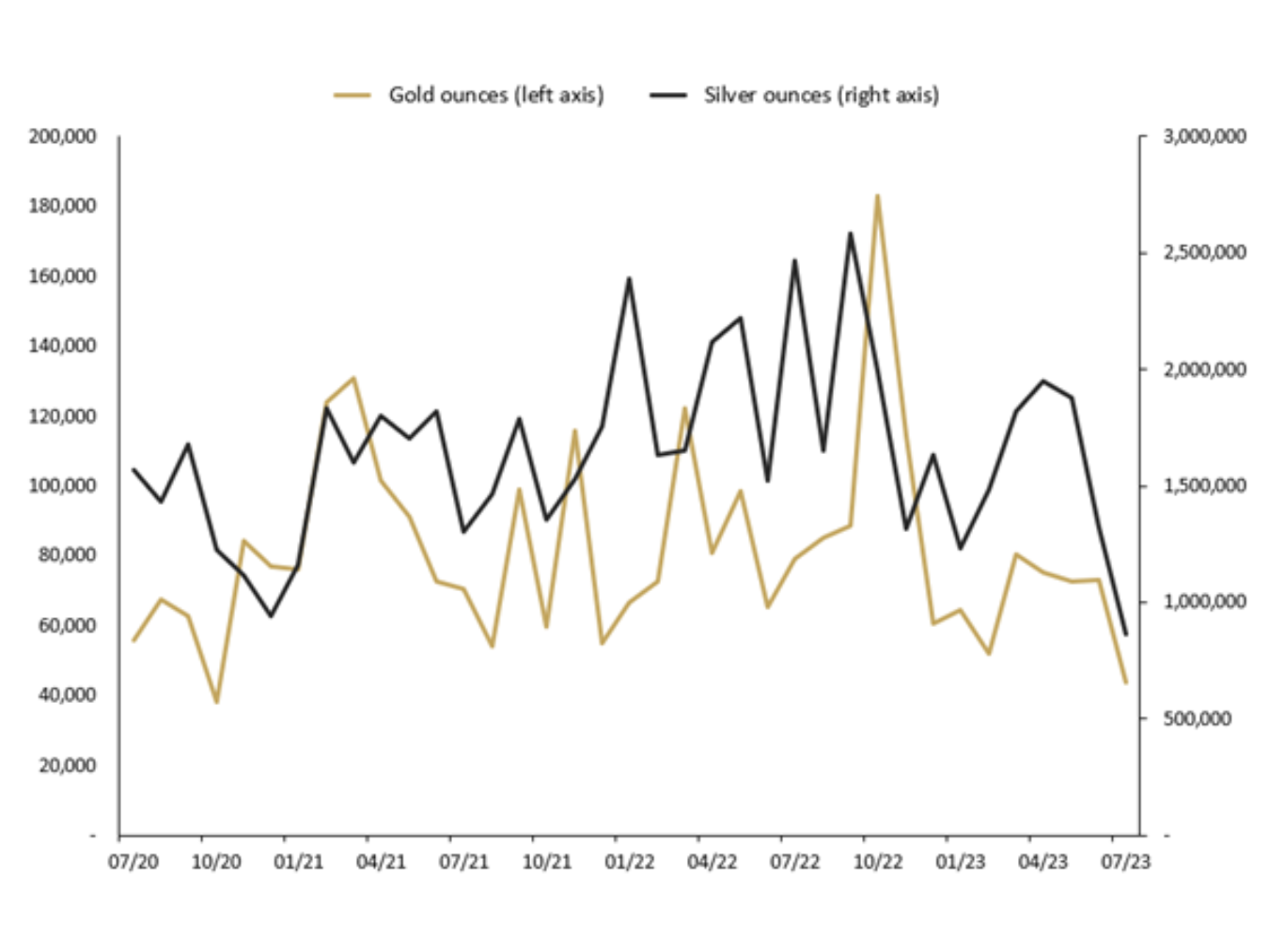

Minted products

The Perth Mint sold 44,009 oz of gold and 863,485 oz of silver in minted product form during July.

The table below highlights how these numbers compare to sales seen one month, three months and one year ago, and against monthly average sales dating back to mid-2012.

Precious metal

Current month

One month %

Three months %

12 months %

Long-term average

Gold

44,009

-39%

-41%

-45%

-17%

Silver

863,485

-35%

-56%

-65%

-19%

JULY 2023 SALES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS (TROY OUNCES) AND CHANGE (%) RELATIVE TO PRIOR PERIODS.

General Manager Minted Products, Neil Vance said the Mint saw a significant decrease in demand for physical bullion products in July. “Our distributors reported softening demand in June and this trend continued into July,” he said, “but they are reluctant to pin the reason on any particular factor at present.”

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian Kangaroo, Kookaburra, Koala and Lunar series. For more product information visit the bullion web page.

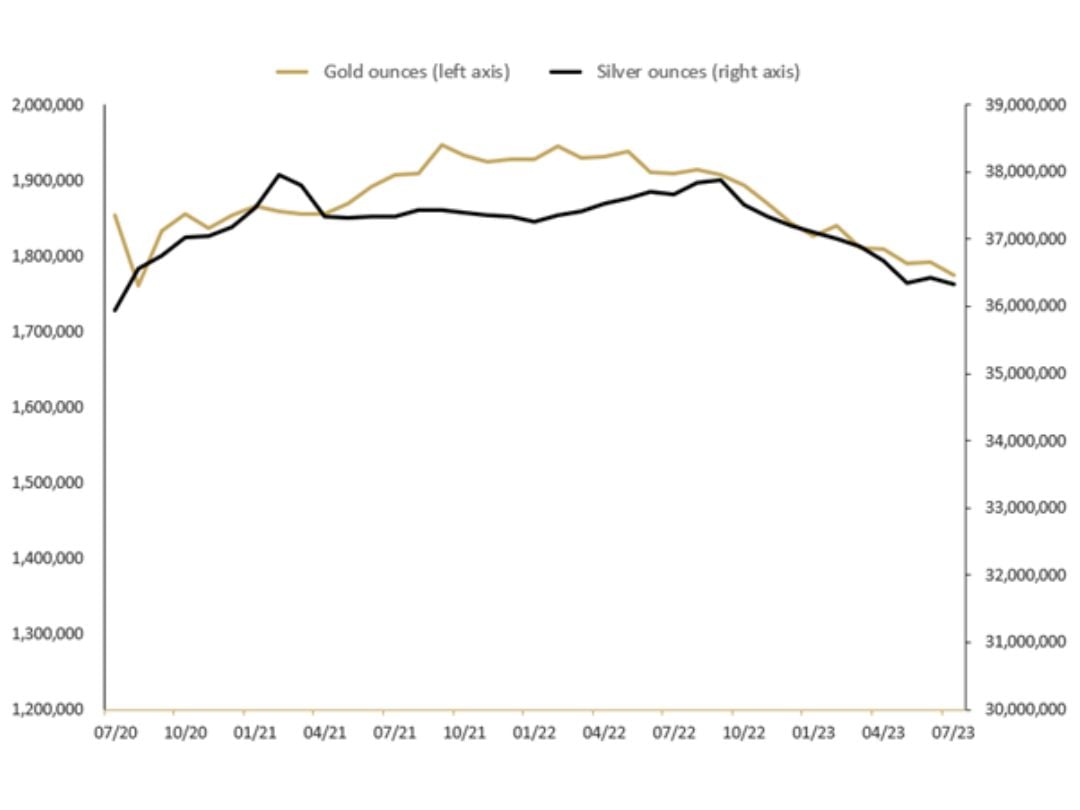

The Perth Mint Depository

In July, the total gold holdings in The Perth Mint Depository decreased by 0.96%, with silver holdings also down by 0.23% in July. Compared to 12 months ago, gold holdings were down 7.00%, while silver holdings were down by 3.52%.

TOTAL TROY OUNCES OF GOLD AND SILVER HELD BY CLIENTS IN THE PERTH MINT DEPOSITORY JULY 2020 TO JULY 2023

The Perth Mint Depository enables clients to invest in gold, silver, and platinum, with The Perth Mint storing this metal in its central bank grade vaults. Operated via a secure online portal, a Depository Online Account allows investors to buy, store and sell their metal 24/7. For further information visit the depository web page.

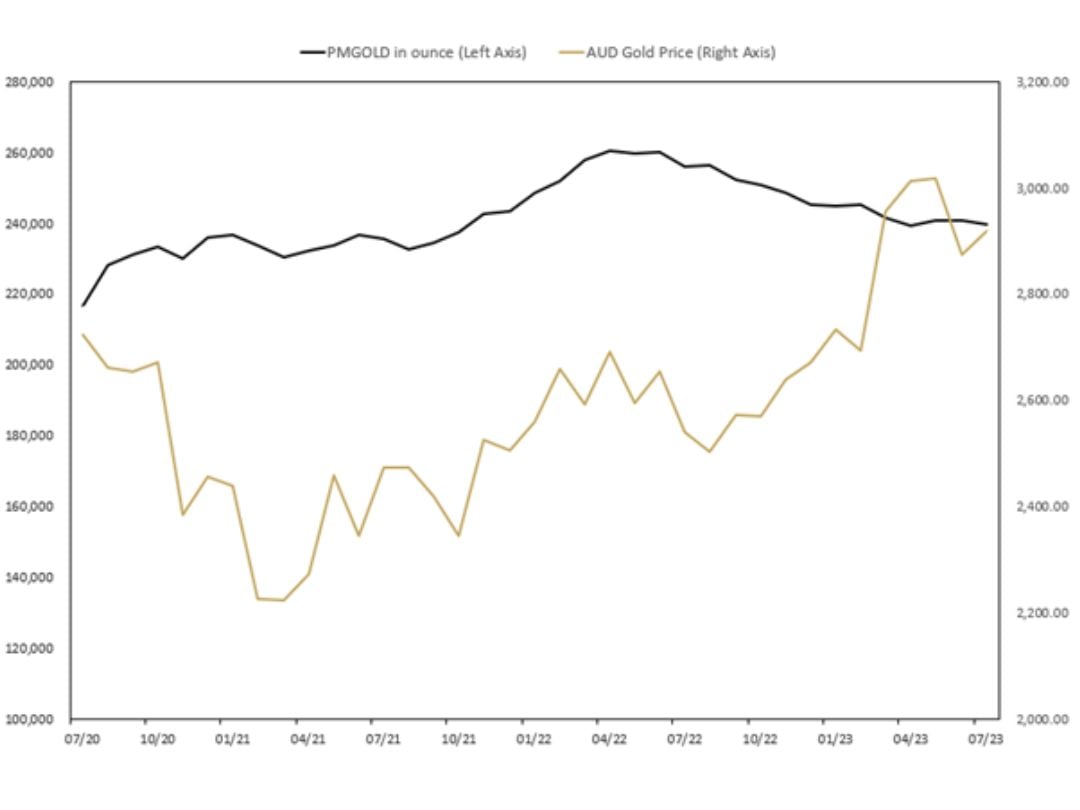

Perth Mint Gold (ASX:PMGOLD)

Total holdings in Perth Mint Gold (ASX:PMGOLD) dropped during July, with holdings decreasing by 1,148 oz (0.48%). This brings total holdings in PMGOLD to 239,571 oz (7.45 tonnes).

MONTHLY CHANGE IN TROY OUNCES HELD BY CLIENTS IN PERTH MINT GOLD (ASX:PMGOLD) JULY 2020 TO JULY 2023

The total value of PMGOLD holdings at the end of July was AUD 700 million with the increase in value attributed to a rising gold price which was trading a little over AUD 2,900 oz at month end.

Perth Mint Gold is an exchange traded product (ETP) that allows investors to trade in gold via a stock broking account as they would shares on the ASX. To learn more, visit the PMGOLD web page.

DISCLAIMER

Past performance does not guarantee future results. The information in this article and the links provided are for general information only and should not be taken as constituting professional advice from The Perth Mint. The Perth Mint is not a financial adviser. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but we do not guarantee their accuracy or completeness. The Perth Mint is not liable for any loss caused, whether due to negligence or otherwise, arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.