Gold demand soft as challenging environment persists

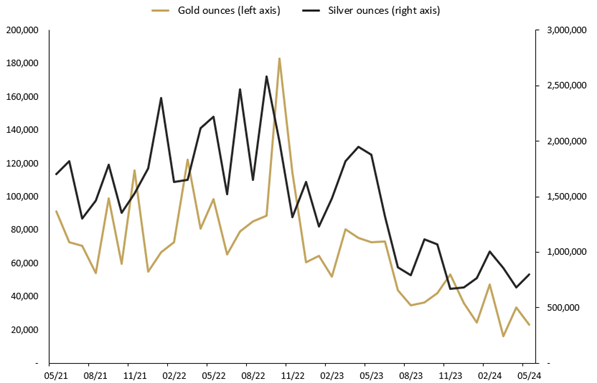

The Perth Mint sold 23,238 troy ounces (oz) of gold and 796,934 oz of silver in minted product form during May 2024.

Opening the month around USD 2,300, the gold price in US dollar terms generally tracked flat before jumping higher by 1.5% off the back of weaker US jobs data which reinforced the potential for a Fed rate cut.

On May 20 bullion hit a record high of $2,449.89, driven by a number of factors in the middle of the month. US CPI print came in under consensus forecasts, further supported by the announcement of Chinese stimulus measures and escalation of geopolitical concerns.

The rapid rise in the gold price was followed by an equally rapid fall over the remaining trading days to end the month around USD 2,350. The main message was the FOMC believes it will have to wait longer for confidence that the inflation rate is moving down towards 2%. This hit gold as investors grew apprehensive over US rate cut timings and on strength in US business activity.

In Australian dollar terms, the gold price moved lower in May. The increase in USD terms was outweighed by a strengthening of the Australian dollar which drove the price of gold in AUD terms slightly lower but still above AUD 3,500.

Silver started the month trading around USD 26.50 and then rose higher on most trading days until hitting USD 32.00. This was its highest level since February 2013. Silver was supported by the same factors as gold coupled with reporting of increased demand for silver which forecasts an overall supply deficit for a fourth year in a row.

The silver price in Australian dollar terms was markedly higher in May in line with the increase in USD terms. Silver was trading near AUD 47 at the end of the month.

The Gold Silver Ratio was 76.5 at the end of May, falling because of the silver price gain and outperformance of gold.

Minted products

The Perth Mint sold 23,238 oz of gold and 796,934 oz of silver in minted product form during May.

The table below shows how these numbers compare to sales one month, three months and one year ago.

Precious metal

Current month

One month %

Three months %

12 months %

Gold

23,238

-30%

-51%

-68%

Silver

796,934

16%

-21%

-58%

MAY 2024 SALES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS (TROY OUNCES) AND CHANGE (%) RELATIVE TO PRIOR PERIODS.

The Perth Mint’s General Manager Minted Products, Neil Vance, said the May results continued the trend of volatility in both gold and silver sales.

“As we have seen in recent times, this instability is a global trend. As the USD gold price has continued to trend higher, we continue to see some resistance from investors but this is inconsistent,” he said.

“I’m pleased to see silver sales bounce back after a softer result in April.

“We are continuing to work hard to design and produce minted products with wide appeal for our global customers.”

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian kangaroo, kookaburra, koala, and lunar series. In addition, periodic releases and series offer investors a choice of alternative design themes.

Bullion coins released in May 2024

- Chinese Myths and Legends Dragon & Koi 2024 1oz Gold Bullion Coin

- Australian Koala 2024 1oz Silver Bullion Coin

For more new product information visit the bullion web page.

Please note: The figures stated in this article are for total monthly ounces of gold and silver shipped as minted products by The Perth Mint to wholesale and retail customers worldwide during May 2024. They exclude sales of cast bars and other activities including sales of allocated/unallocated precious metals for storage by The Perth Mint Depository.

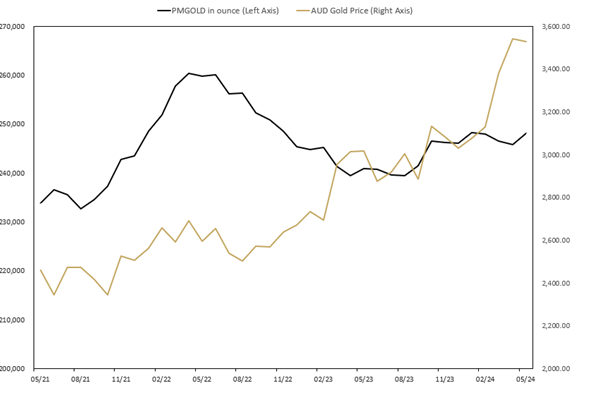

Perth Mint Gold (ASX:PMGOLD)

Perth Mint Gold is an exchange traded product (ETP) that allows investors to trade in gold via a stock broking account as they would shares on the ASX. To learn more, visit the PMGOLD web page. PMGOLD webpage.

Total holdings in Perth Mint Gold (ASX:PMGOLD) increased during May, with holdings increasing by 2,314 oz (0.94%). This brings total holdings in PMGOLD to 248,135 ounces (7.72 tonnes).

MONTHLY CHANGE IN TROY OUNCES HELD BY CLIENTS IN PERTH MINT GOLD (ASX:PMGOLD) MAY 2021 TO MAY 2024