Gold bullion demand higher for fourth month in a row

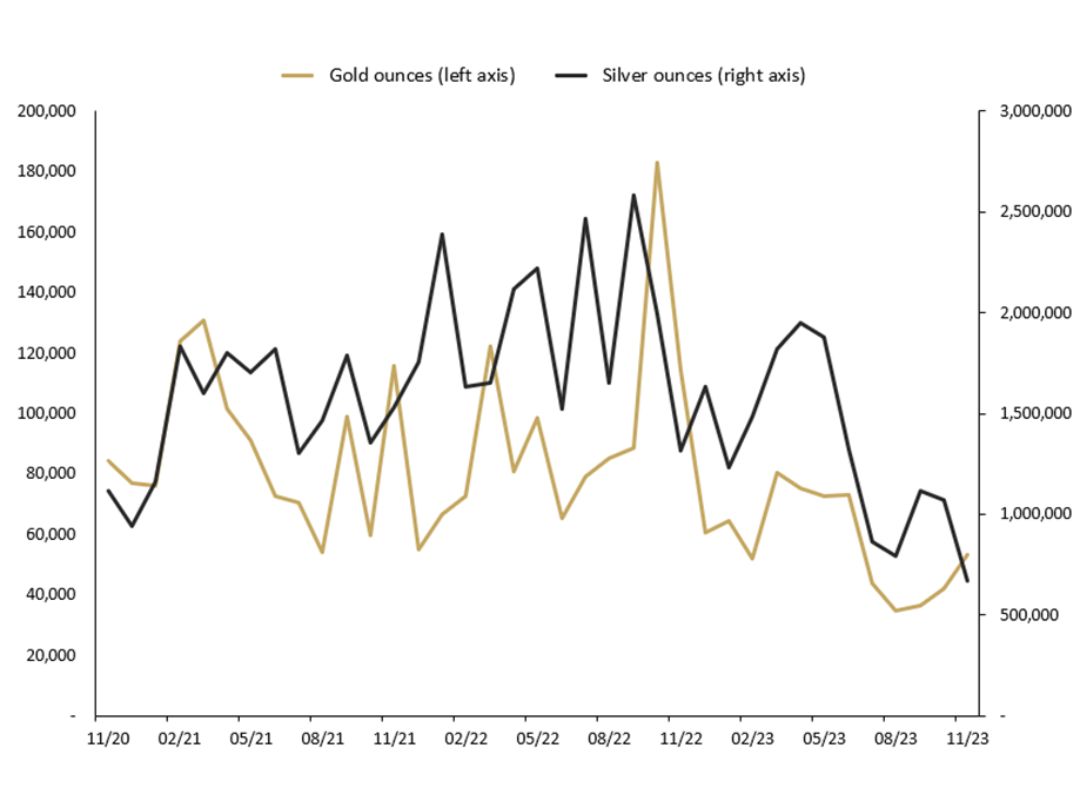

The Perth Mint sold 53,520 troy ounces (oz) of gold and 672,623 oz of silver in minted product form during November 2023.

The gold price performance in November was a tale of two halves - before and after the mid-month release of October’s CPI report. Prior to its release, gold drifted lower, trading down near USD 1,936 an ounce at one stage. Post release of the data, which showed annual core inflation in the US easing to 4% (the smallest gain since September 2021), gold began moving higher. With expectations rising that the Federal Reserve was done raising interest rates, gold consolidated its gains following the release of the latest FOMC minutes. Containing comments that were interpreted as positive for gold, prices broke through the USD 2,000 barrier on 21 November.

The gold price in Australian dollar terms moved lower during the month after hitting a record high price in October. The price was driven lower by the strengthening of the Australian dollar by nearly 4% over the month. The RBA increased its key interest rate by 25 basis points to 4.35% in November.

Silver tracked materially higher in the period. After hitting lows of near USD 22 early in November, it bounced to near USD 25 by month’s end, again displaying its tendency to outperform during periods of heightened expectations.

The silver price in Australian dollar terms was higher in November, up near 3.5% for the month, a strengthening FX rate tempering some of the gains experienced in USD terms.

During November, the Gold Silver Ratio decreased and ended the month on 80.44.

Minted products

The Perth Mint sold 53,520 oz of gold and 672,623 oz of silver in minted product form during November.

The table below highlights how these numbers compare to sales seen one month, three months and one year ago, and against monthly average sales dating back to mid-2012.

Precious metal

Current month

One month %

Three months %

12 months %

Long-term average

Gold

53,520

27%

53%

-53%

1%

Silver

672,623

-37%

-15%

-49%

-37%

NOVEMBER 2023 SALES OF GOLD AND SILVER SOLD AS COINS AND MINTED BARS (TROY OUNCES) AND CHANGE (%) RELATIVE TO PRIOR PERIODS.

The Perth Mint’s General Manager Minted Products, Neil Vance, said sales of Australian gold bullion strengthened month on month. “Strong demand for Kangaroo Minted Gold Bars through October continued in November. Added to this was interest in the release of our annual Australian Lunar coin series for 2024 with designs celebrating the Year of the Dragon.”

The Perth Mint’s General Manager Minted Products, Neil Vance, said sales of Australian gold bullion strengthened month on month. “Strong demand for Kangaroo Minted Gold Bars through October continued in November. Added to this was interest in the release of our annual Australian Lunar coin series for 2024 with designs celebrating the Year of the Dragon.”

The silver market, however, remained subdued. With prices rising during the second half of the month, distributors reported that many investors decided to cash-in, with sell-backs particularly noticeable in Asia. “The main interest in silver during November came from the new Australian Lunar silver coins and their popular design theme,” he added.

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar Program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian Kangaroo, Kookaburra, Koala and Lunar series. In addition, periodic releases and series offer investors a choice of alternative design themes.

Bullion coins released in November 2023

- Australian Lunar 2024 Year of the Dragon 10oz, 2oz, 1oz, 1/2oz, 1/4oz, 1/10oz Gold Bullion Coins

- Australian Lunar 2024 Year of the Dragon 2oz, 1oz, 1/2oz Silver Bullion Coins

- Australian Lunar 2024 Year of the Dragon 1oz Platinum Bullion Coin

For more new product information visit the bullion web page.

Bullion coins ‘sold out’ at The Perth Mint in November 2023

- N/A

Please note: The figures stated in this article are for total monthly ounces of gold and silver shipped as minted products by The Perth Mint to wholesale and retail customers worldwide during November 2023. They exclude sales of cast bars and other activities including sales of allocated/unallocated precious metals for storage by The Perth Mint Depository.

DISCLAIMER

Past performance does not guarantee future results. The information in this article and the links provided are for general information only and should not be taken as constituting professional advice from The Perth Mint. The Perth Mint is not a financial adviser. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but we do not guarantee their accuracy or completeness. The Perth Mint is not liable for any loss caused, whether due to negligence or otherwise, arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.