How do our numismatic coins differ from our bullion coins?

In broad terms, The Perth Mint manufactures and markets precious metal coins for two purposes.

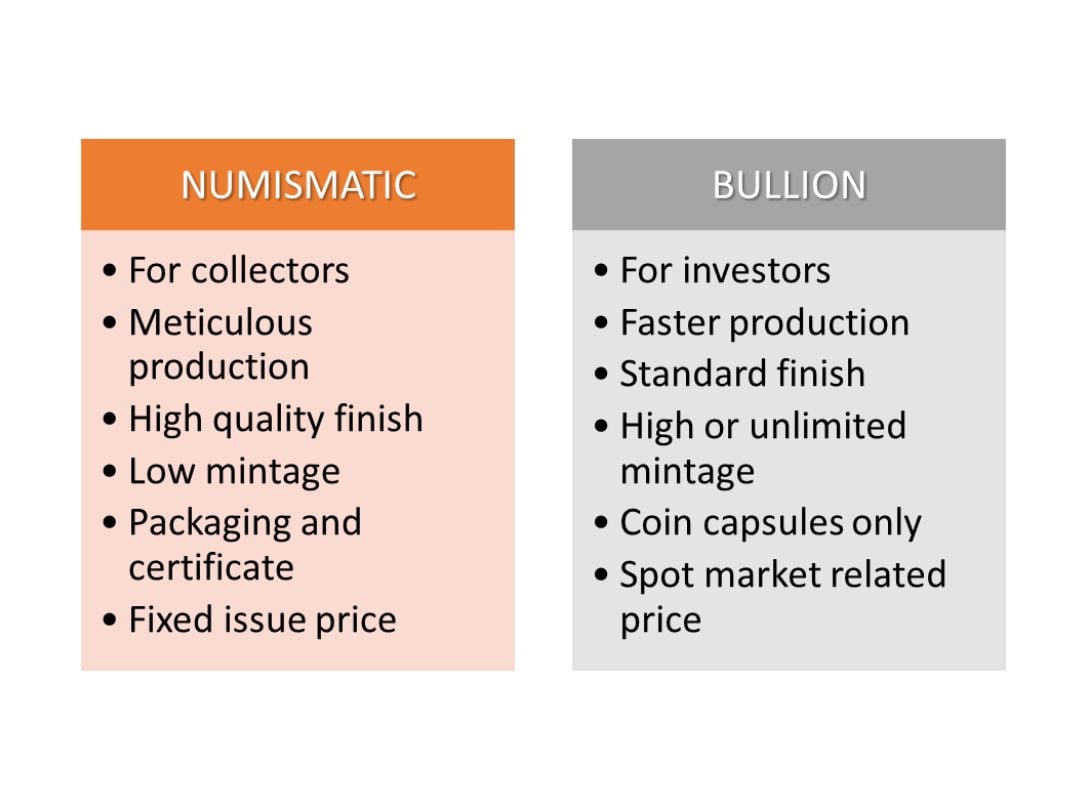

What we often refer to as ‘numismatic’ pieces are crafted for collecting, whereas our ‘bullion’ coins are manufactured with investing in mind.

Both numismatic and bullion coins are made from exactly the same purity of metal – 9999 gold, 9999 silver, or 9995 platinum. In many cases, they even share the same designs.

If you’ve ever been curious about what makes a numismatic release different from a bullion release, this article is here to help.

But first, let’s establish what motivates your interest in coins.

Collecting

Research has shown that humans are motivated to collect objects for many reasons. Throughout history, coins have generated particular interest. For many, it is the human stories that are associated with them.

During the Renaissance, ancient Roman coins depicting the heads of different Emperors became extremely popular. So many members of European royalty and their courtiers began collections that numismatics earned the nickname ‘the hobby of kings’.

As well as the person depicted in the design, these collectors were also attracted by the condition and rarity of each piece. Today, those interested in modern numismatics are just as likely to be motivated by these factors.

Investing

Gold has been sought after for millennia as a symbol of wealth and power. Alongside other ‘noble’ metals such as silver and platinum, it is popular with modern investors for a number of reasons.

Not only is gold considered to be a good portfolio diversifier, but history shows that it can help hedge against inflation and protect wealth during times of market instability.

Bullion coins that are trusted for their weight and purity provide investors with a convenient and cost-effective way of acquiring gold, silver, and platinum to meet such objectives.

Coin finishes

Having identified why you might be interested in either collector coins or bullion coins, it’s time to examine in more detail how we differentiate the two.

As we’ve already established, all Perth Mint coins are made from the same pure gold, silver, and platinum. In terms of physical differences between numismatic and bullion, the answer lies in the type of finish we apply.

Collectable coins are most associated with a proof quality finish. Proof coins were originally made as showpieces to demonstrate the craftsperson’s expertise.

The coin table (background) is highly polished and mirror-like. Traditionally, raised design elements are delicately frosted. (However, we sometimes colour or gild them in 24 carat gold.)

The blank for a proof coin is struck by an expertly prepared die at least three times in succession to ensure the design is both clear and crisp.

Because of the time and skill involved in creating proof quality coins, this finish is reserved for our most limited, highly prized numismatic issues.

The finish on many bullion coins issued worldwide is uniform without any distinctively polished or frosted areas, our Australian Kangaroo silver bullion coin is a good example.

Historically, however, The Perth Mint has had a different approach. The majority of our bullion coins feature a frosted table and a shiny design (the opposite way round to proof issues). Although each bullion blank is struck less often than a proof, the final look is exceptional compared to conventional investor pieces.

Indeed, we are renowned for one of the best quality bullion finishes in the world.

Rarity

In the world of collecting, rarity is key. That’s why our proof quality collectables are limited to low mintage figures that are stated up front and never exceeded.

This can be guaranteed. Before any coin is issued by The Perth Mint under the Australian Currency Act 1965, its design and the total number to be produced must first be authorised by Treasury, this also applies to coins issued under the authority of other governments.

Typically, the mintage for our numismatic coins ranges from 50 to 5,000 – these are desirable numbers which often result in rapid sell outs.

While bullion coins are subject to the same Treasury or government issuing authority approval rules, the mintage numbers are usually much, much higher, and are sometimes stated as ‘unlimited’.

This is because investors are more interested in the underlying value of the gold, silver, and platinum in their coin.

Our ability to ‘mass’ produce bullion coins in large numbers has a direct bearing on their issue price.

Issue price

The issue price (that is the Mint’s asking price for any new coin) is based on the value of the piece’s precious gold, silver, or platinum.

For every numismatic release, the issue price includes a premium to cover the cost of the complex and labour-intensive production, as well as presentation packaging and a certificate of authenticity - elements that add to its allure as a rare and beautiful collectable.

With these factors accounted for, the issue price of a low mintage numismatic coin is generally a set retail price on release, though sometimes changes to this are necessary. Even if the coin is headed for a rapid sell out at the Mint, there can be no question of raising the price to try and balance supply and demand.

By comparison, the production premium for bullion coins made in large numbers is lower. An acrylic capsule to protect each coin also reduces packaging costs. As a result, the issue price of each bullion piece is close to ‘spot’ – the prevailing price paid by traders in professional markets.

Spot prices are in constant flux, changing minute-to-minute, even second-to-second throughout the day and night. The price of bullion coins tracks these movements, enabling investors to gauge the best time to buy (or sell).

Conclusion

In summary, numismatic coins offer the pleasure and satisfaction of building a collection of attractive, limited edition objects celebrating themes that appeal to individual collectors. If they increase in value over time, that’s an added bonus!

Bullion coins are made for the purpose of investing in precious metals. Sold with low premiums, they offer a cost-effective way of acquiring gold, silver, and platinum with guaranteed weight, purity, and tradability.

DISCLAIMER

Past performance does not guarantee future results. The information in this article and the links provided are for general information only and should not be taken as constituting professional advice from The Perth Mint. The Perth Mint is not a financial adviser. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but we do not guarantee their accuracy or completeness. The Perth Mint is not liable for any loss caused, whether due to negligence or otherwise, arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.